ny paid family leave tax rate

An employers experience rate will not necessarily increase. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

The maximum annual contribution is 38534.

. For 2022 the contribution rate for Paid Family Leave will remain as 0511 of the employees weekly wage capped at the New York. Bond with a newly born adopted or fostered. The maximum annual contribution is 42371.

Read the full bulletin. Rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York average annual wage of 7540884. Accordingly based on commonly accepted actuarial principles the Superintendent has determined that the premium rate for Paid Family Leave benefits for coverage beginning January 1 2022 shall remain at the level as the premium rate applicable for calendar year 2021 and be set at 0506 plus 0005 for the Risk Adjustment for the COVID-19 claims paid under.

In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy. Share by Twitter. Maximum Weekly Wage Replacement.

This is 9675 more than the maximum weekly benefit for 2021. On December 29 2021 the Office of the State Comptroller issued State Agencies Bulletin No 1982 to inform agencies of the 2022 New York State Paid Family Leave Program rate. 2020 Paid Family Leave Payroll Deduction Calculator.

New York Paid Family Leave NY PFL is a benefit program that offers paid leave to New York employees while they bond with a new child care for a close relative with a serious health condition or when an employees. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. 2020 New York State Paid Family Leave Rates.

Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. General Employer Considerations and Action Items. Paid family medical leave.

Would an employers experience rate increase in the next year if an employee uses the Paid Family Leave program. Paid family medical leave. In 2021 the contribution is 0511 of an employees gross wages each pay period.

Up to 100 of the family leave contribution can be withheld from a covered individuals wages 012 of eligible wages. Ny Paid Family Leave Insurance Tax If the amount of time entered is less than the percentage allowed no system message will display. Paid Family Leave provides eligible employees job-protected paid time off to.

Therefore a maximum contribution of 741 per week per employee in 2021 regardless of age gender or. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. 2019 NY PAID FAMILY LEAVE PREMIUM RATE INFORMATION Effective January 1 2018 New York State enacted New York Paid Family Leave PFL - one of the most comprehensive family leave programs in the nation.

Avoid a Delay in Benefits Eligibility Depending on when DBPFL coverage is obtained by certain types of businesses there could be a delay in benefits eligibility. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current average weekly wage of 145017. The program offers to 12 weeks paid leave at 67 of the employees average weekly wages up to the maximum benefit of 67 of the New York State AWW.

Yes you are able to supplement your PFL payments with vacation or PTO. Duration maximum 12 weeks. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

New York contd. N-17-12 New York States New Paid Family Leave Program. 2022 New York State Paid Family Leave at a Glance.

NEW YORK PAID FAMILY LEAVE 2020 vs. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld. Paid Family Leave PFL is now available to eligible employees of the City of New York.

New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0270 of your gross wages each pay period. Duration maximum 10 weeks.

Paid family medical leave. There is no employer share for employers with fewer than 25 covered. 027 maximum of 19672 per year None.

Balance of costs over employee contributions necessary to provide benefits. The maximum contribution is 38534 per employee per year. There are various factors that can impact an experience rate such as overall benefits paid to former employees and whether contributions are paid timely.

140117 weekly Oregon. 0511 maximum of 38534 per year None. This rate is the same for all employees regardless of gender or age.

145017 weekly Oregon. The maximum contribution will be 38534 per employee per year. Paid family medical leave.

Payroll Deductions per pay period 027 of employees gross wages each pay period. Contribution rate for Paid Family Leave in 2021 is 0511 of the employees weekly wage capped at New Yorks current average annual wage of 7540884. Balance of costs over employee contributions necessary to provide benefits.

Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371. The weekly benefit amount will be 67 up to 97161 per. Weekly Benefit 60 of AWW max AWW 84070 Weekly Benefit 67 of AWW max AWW 97161 7286084 annual wage cap 7540884 annual wage cap 140117 average weekly wage 145017 average weekly.

60 of employee AWW. New York State Paid Family Leave. Use the calculator below to view an estimate of your deduction.

Today working families no longer have to choose between caring for their loved ones and risking their economic security. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. PFL benefit s areavailable to employees of private sector employers with one or more employees and will be phased in over a four-year period.

In 2020 these deductions are capped at the annual maximum of 19672. Up to 100 of the medical leave contribution can be withheld from a covered individuals wages 0224 of eligible wages. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

Do You Have To Pay Tax On Your Social Security Benefits Youtube

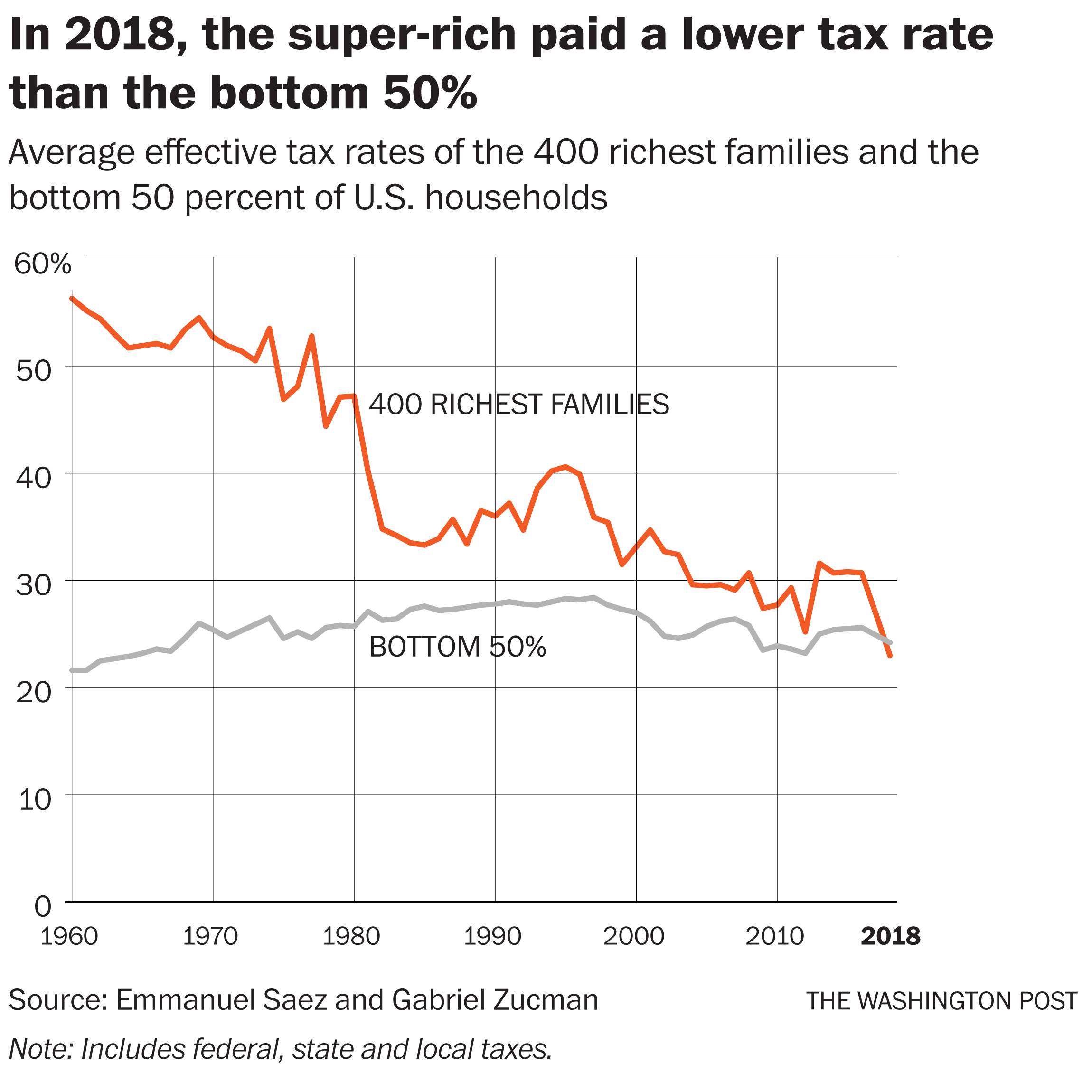

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Cost And Deductions Paid Family Leave

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

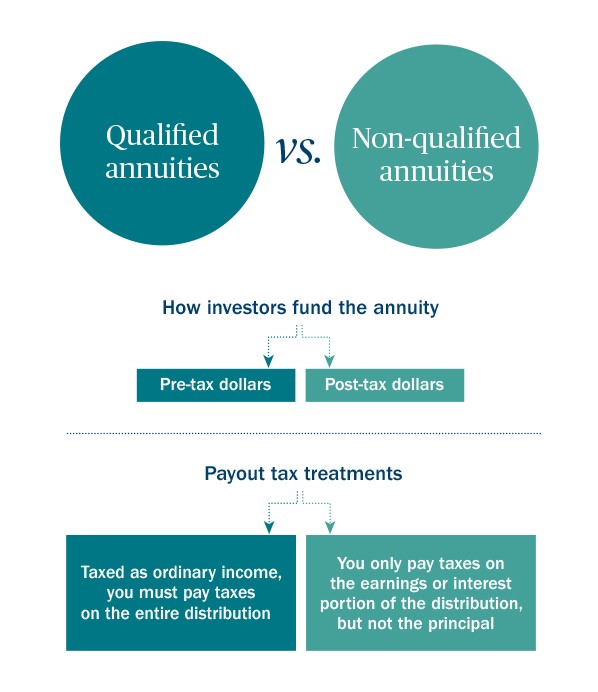

Taxation Of Annuities Ameriprise Financial

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2022 Federal State Payroll Tax Rates For Employers

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)

Illegal Immigration Taxes Unauthorized Immigrants Pay State Taxes Vox

Find Out If Social Security Disability Back Pay Is Taxable

Dbl State Disability Claim Packet Ny Sny9457 Pdf Disability Benefit Templates Disability

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)